Albert Einstein once said that the income tax is the hardest thing to understand. We suppose that he was not familiar with the US sales tax system. He could have been surprised at what a nexus is or how tax rates differ from state to state. Today we will talk about this and much more. Stay tuned to find out how sales taxes are calculated for Amazon sellers, how to file reports, and which tools are the best.

Table of content:

- What Does Sales Tax Mean?

- Amazon FBA Sales Tax: When to Collect?

- How to Get Amazon Sales Tax Compliant

- How to Start Collecting Sales Tax

- How to Report and File Amazon Sales Tax

- What Sales Tax Tools to Use

- What Are Amazon FBA Tax Deductions

- How to Improve Your Sales Tax Process Flow

- Benefits of Paying Amazon FBA Sales Tax

- Final word

What Does Sales Tax Mean?

Why do you have to pay taxes on Amazon sales? Obviously, to feed local budgets. Sales tax is a reality for everyone who sells goods in a physical store or online. However, for Amazon FBA sellers, the tax system is more complicated than for other retailers.

Amazon FBA sales tax is a tax that customers pay when they buy a product. The business owner then deducts this amount from the commission and passes it on to the state and local governments. Remember that it is not an income tax paid on net income depending on its amount and tax category.

Does Amazon file sales tax for sellers? Well, Amazon calculates, collects, and remits sales taxes for its sellers who ship to states with respective laws. You can find information about local laws on the Marketplace Tax Collection page. However, Amazon does not report or remit FBA taxes to the government on behalf of the sellers and does not take responsibility for their tax obligations.

Amazon FBA Sales Tax: When to Collect?

To work within the US tax laws, Amazon sellers must collect sales tax. It applies to sales in states where your business meets the sales tax nexus and product taxability. If you want to avoid it, sell tax-free products in states that do not provide for such obligations.

Read on to learn about sales tax nexus and product taxability.

Sales Tax Nexus

The sales tax nexus is what legally confirms your connection with the state. You always have it in your home state and can create another one in other states if that implies your business activity.

Sales Tax Nexus In Different States

Reasons why you have sales tax nexus in different states:

- If your company has a physical presence in the form of an office, shop, or warehouse.

- If employees, contractors, vendors, or other employees work for you.

- If affiliates advertise your products in different states for a commission on profits.

- If you are selling products at a trade show or other event.

- If you are using 3rd party logistics.

- If you exceed a certain number of transactions or dollar amount of sales.

- If you store inventory in a warehouse in this state without having the office and staff there.

Sales Tax Nexus and Inventory

Let’s take a closer look at the last point on the list, as it is especially relevant for Amazon FBA sellers.

From the government’s point of view, any seller that uses the state’s resources, whether shipping ways or premises, has a nexus. So even if you store your FBA inventory in an Amazon fulfillment center, you still have to pay sales tax.

List of Amazon Fulfillment Centers in the US

Amazon has fulfillment centers in many US states to ensure fast orders:

- Arizona

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Kentucky

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Nevada

- New Hampshire

- New Jersey

- North Carolina

- Ohio

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Virginia

- Washington

- Wisconsin

Keep in mind that Amazon will unlikely store your inventory in every state mentioned above. Check the information from the Inventory Event Detail Report on Amazon Seller Central.

Point to Remember

Thanks to the Marketplace Facilitator Law, marketplaces like Amazon are responsible for collecting sales tax on behalf of their sellers. The law simplifies the companies’ activities but does not exempt them from obtaining a sales tax permit and filing tax returns. It includes states where you have a nexus, and Amazon collects and remits sales tax on your behalf.

However, if you sell on other platforms (not marketplaces), you still need to collect sales tax from all buyers in the nexus states.

Product Taxability

For sales tax, not only the nexus is essential but also the product itself. Only physical goods are taxed (not services), but there are some exceptions.

Items such as groceries, supplements, clothing, and books are not taxed or have a reduced rate, depending on the state. You can obtain information about whether your product is taxed in a particular state from the tax authority website or by telephone.

And if you are reselling an item, you can provide a resale certificate and get a sales tax exemption — it works in most states.

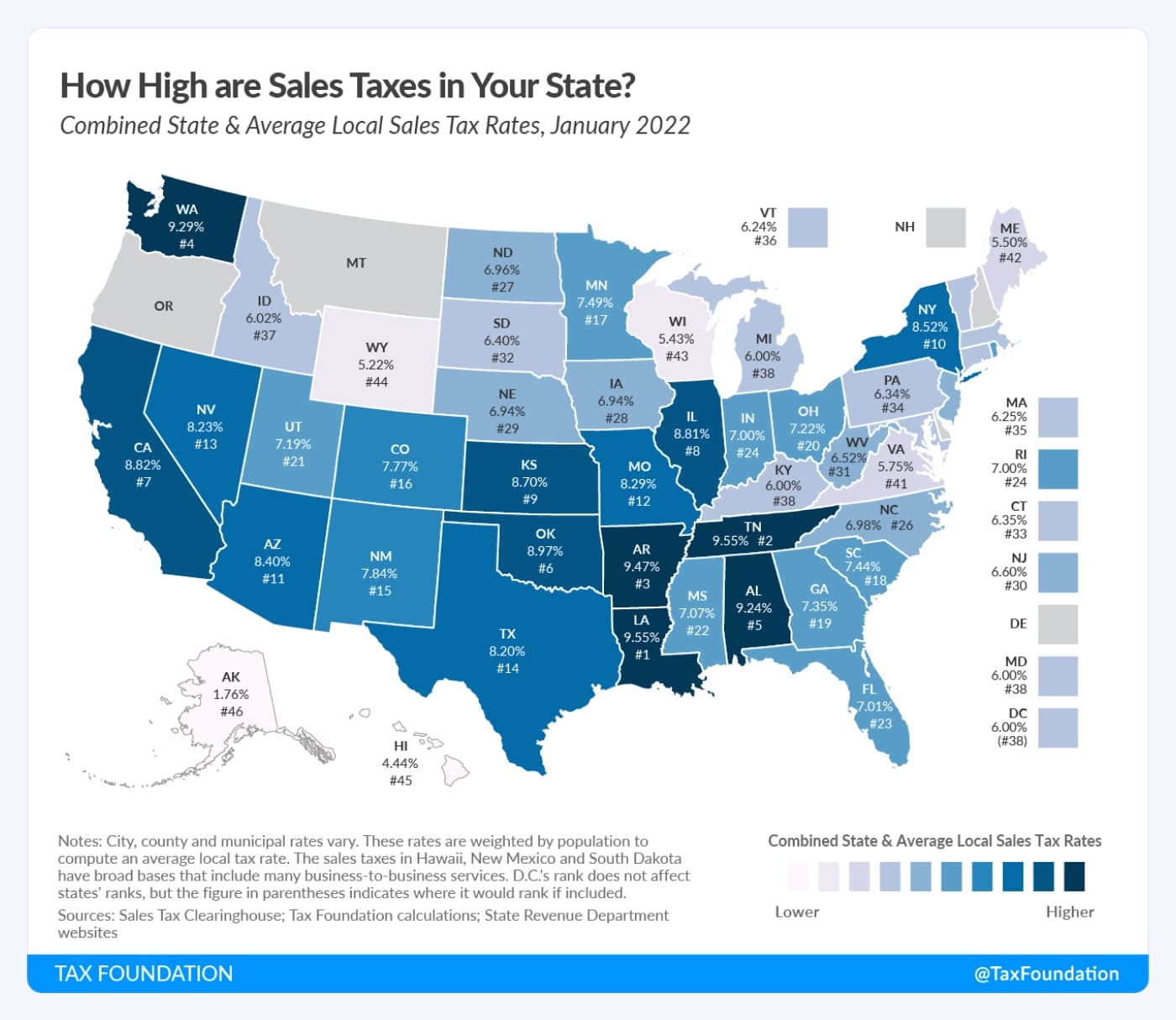

States Without FBA Sales Tax

You may have a good feeling about five US states that do not require statewide sales taxes. These include New Hampshire, Oregon, Montana, Alaska, and Delaware — or NOMAD. However, some local authorities in these states are allowed to levy sales and excise Amazon FBA taxes.

- New Hampshire does not practice a sales tax, but some goods require a 7-9% excise tax for meals, room and car rentals, restaurants, and mobile phone services.

- Oregon’s tax policy is similar to New Hampshire’s. Here, excise taxes are imposed on goods such as alcohol, cigarettes, tobacco, gasoline, and other products. And in some cities, a sales tax is levied. For example, in Ashland, the buyer of ready meals pays an extra 5% to the cost.

- Cities in Montana charge resort and local taxes. Resort tax is levied on goods and services sold in recreational areas, restaurants, bars, hotels, and campsites. It is practiced in Red Lodge, Virginia City, West Yellowstone, and Whitefish, and the tax does not exceed 3%.

- In Alaska, some municipalities have local sales taxes: 3% in Kalifornsky, 5% in Juneau, and 6% combined sales tax in Soldotna.

- The state of Delaware is completely exempt from sales tax for the buyer. At the same time, some enterprises must pay tax on gross proceeds — from 0.0945% to 0.7468%, depending on the type of business activity.

How to Get Amazon Sales Tax Compliant

You may be ready to start collecting sales taxes, but there are still some steps to take. If you have a nexus or sell taxable goods, first, you need a sales tax permit. Remember that levying sales tax without registration is illegal.

To register within a state to collect sales tax:

1. Gather your personal and business identification information.

2. Go to the State’s Department of Revenue website.

3. Click on the “Sales and Use Tax” section.

4. Click on the required link to start registration.

With a permit, you get your filing frequency — you can file your tax returns monthly, quarterly, or annually. The frequency depends on the sales volume: the higher the sales, the more often you file a declaration.

How to Start Collecting Sales Tax

Amazon collects sales tax on sellers’ behalf in most states with its fulfillment centers. At the same time, the marketplace has a very robust sales tax collection engine. It considers whether your state is “origin-based” or “destination-based.” You can add “product tax codes” to charge the correct amount for different product categories and choose whether to tax shipping and gift wrapping.

Origin or Destination-Based State?

Let’s delve into the concept of origin-based and destination-based states.

Origin-Based Sales Tax

Sales tax in an origin-based state is levied due to your location in that state as a seller. This rate depends on state, county, city, and district tax rates.

For example, if you are located in Salt Lake City, Utah, and sell to a customer in Provo, Utah, the sales tax rate is based on Salt Lake City’s local laws.

The list of origin-based states includes:

- Arizona

- California*

- Illinois

- Mississippi

- Missouri

- Ohio

- Pennsylvania

- Tennessee

- Texas

- Utah

- Virginia

*California has a hybrid system where state, county, and city taxes are origin-based, and district taxes are destination-based.

Destination-Based Sales Tax

If you sell in a destination-based state, you charge sales tax based on the rates of the destination state, that is, your buyer’s location. As with the origin-based state, this rate includes a combination of state, county, city, and district tax rates.

For example, you sell your product to a customer in Chesterfield, South Carolina, and your company is located in Columbia, South Carolina. South Carolina is a destination-based state, so you collect sales tax under Chesterfield law.

Who else is a destination-based state?

All other 36 states that are not included in the lists of sales tax-free and origin-based states.

The destination-based system is more confusing as states can have hundreds of tax jurisdictions that will tax your goods. Such a tax policy aims to keep the consumer’s money in his home area.

Sales Tax for Amazon Remote Sellers

You are a remote seller if you have a multi-state nexus. For example, if you are located in Mississippi but also have connections in Louisiana, you are considered a remote seller in Louisiana.

Typically, remote sellers use a destination-based system, orienting at the buyer’s state. There are only a few exceptions, such as California, New Mexico, and Arizona. Here, the sales tax is collected at the origin state of the fulfillment center.

For example, you are in Ohio, and your product is shipped from an FBA center in Los Angeles, California, to a customer in San Diego, California. Then, you charge sales tax at the Los Angeles rate.

The Most Populated US States and Their Tax Authorities

We have already discussed the importance of getting a sales tax permit. And here are the links to state tax authorities in the most populated states:

- California: California Department of Tax and Fee Administration

- Florida: Florida Department of Revenue

- Illinois: Illinois Department of Revenue

- New York: New York State Department of Taxation and Finance

- Ohio: Ohio Department of Taxation

- Pennsylvania: Pennsylvania Department of Revenue

- Texas: Texas Comptroller

In many states, Amazon collects and remits sales taxes automatically. To view your current settings, sign in to Amazon Seller Central and navigate to “Tax Settings.” Next, check if you have set up your product-specific tax codes. For example, if you do not choose a higher tax rate for products that require it, you will receive fewer Amazon FBA taxes and, finally, will pay the difference. On the other hand, some of your products may be exempt from sales tax, and you should specify it as soon as possible.

How to Set Up Sales Tax Collection

Follow these simple steps to set up sales tax collection:

1. Sign in to Amazon Seller Central.

2. In the Settings tab, select “Tax Settings.”

3. Choose the option “View/Edit your Tax Collection and Shipping & Handling and Giftwrap Tax Obligations Settings.”

4. In the Add States option, select the states where you want to collect sales tax and click “Add Selected States.”

5. For each state, enter the tax ID received during registration.

Please note that Amazon charges a 2.9% fee per transaction when it charges sales tax.

How to Set Up Product Tax Codes

To set up product tax codes on Amazon FBA:

1. Log in to Amazon Seller Central.

2. In the Settings tab, select “Tax Settings.”

3. Choose the option “View Master Product Tax Codes and Rules.”

4. Choose the tax codes that best suit your products.

Let’s take a look at examples.

- A_FOOD_GEN is used for food labeling. Food is taxed differently; for example, candies (A_FOOD_CNDY) and carbonated soft drinks (A_FOOD_SFTDK) have separate tax codes.

- A_CLTH_GEN is used to label clothes. In some states, most clothing is tax-free, except sportswear, formal wear, and accessories. Bags (A_CLTH_HBAGS) and suits (A_CLTH_CSTUMS) use separate tax codes.

- If you can not find a tax code for a product, mark it as A_GEN_TAX, or if you do not want to tax it, mark it as A_GEN_NOTAX.

How to Report and File Amazon Sales Tax

Well, it is time you filed a tax return. First, you need to enter the sales tax you received in each state.

Tips About Filling Sales Tax Declaration

Let’s talk about essential things to remember when filling out the declaration:

- Do not forget that you must file tax returns in all states where you sell, even if Amazon collects sales taxes on your behalf.

- To prevent discrepancies in income and taxes, report all sales, including those made outside the marketplace.

- If you did not collect Amazon seller sales tax during the period, file a “zero return.” If you violate this rule once, you receive a fine, and if you violate this rule repeatedly, the state cancels your permit.

- Some states give sellers a 1-3% sales tax “discount,” which can be unpaid. So be sure to take advantage of this bonus.

How to File Amazon Sales Tax Returns

The main difficulty with sales tax returns is that most states want to know how much Amazon FBA tax you have collected in each county, city, and district. You can find out these details in two ways:

Manually

You can generate a report manually:

1. Sign in to Amazon Seller Central.

2. Find the Reports tab and click on Payments.

3. Select Generate Date Range Report and specify the filing period.

You can organize sales information from each state, county, city, and district, but be prepared that it takes a long time.

Automatically

Automated solutions help you generate tax returns faster and easier. Special software synchronizes with all sites and marketplaces where you sell. In the end, you get a detailed sales tax report for each state, county, city, and district. So you do not need to waste your time on maps and tables to prepare a declaration for state tax authorities.

What Sales Tax Tools to Use

Sales tax tools for Amazon FBA can significantly simplify your life, saving you time and effort. There is a wide variety of such software on the market, but we will talk about the most popular ones:

TaxJar

TaxJar is one of the most well-known sales tax reporting solutions. The software has basic functionality and a friendly, intuitive interface. The TaxJar sales tax compliance platform includes real-time calculation, sales tax reports, nexus insights, automated tax filing, and remittance. In addition, it easily integrates with marketplaces like Amazon, eBay, Etsy, Shopify, and the most famous eCommerce CRM systems.

Pricing starts at $19/month for the Starter plan and $99/month for the Professional plan. Also, you can try your 30-day free trial.

Avalara

Avalara is also a good tax reporting solution. The software integrates with significant marketplaces, helps sellers with sales tax, and suggests consumer use tax, customs duties, and import tax solutions. In addition, you can calculate tax rates, control your nexus, prepare returns, and manage documents for sales tax.

One of the main advantages of Avalara is high-quality expert support, which allows you to check reports and file a declaration on your behalf for a fee.

The Basic package costs $19/month, and the Standard package is $83/month. A free trial for up to 60 days will help you decide.

Sovos Taxify

Sovos Taxify is a convenient and easy-to-use solution for automating tax processes. The software contains ready-made forms for Amazon that consider the rules of the tax jurisdictions of all 50 states. It manages value-added, sales- and use taxes, shipping and distribution compliance, and tax and regulatory reporting. Taxify is compatible with marketplaces like Amazon and eBay and CRM/ERP solutions like SAP, Oracle NetSuite, and Magento.

Pricing starts from $47/month for the Standard package, and the Pro membership costs $247. You can also use a free 30-day trial.

What Are Amazon FBA Tax Deductions

Honestly, you have little control over your sales tax payments. But as an FBA retailer, you can reduce your tax bill at the end of the year. Make sure you consider all tax deductions that apply to your business.

Tax deductions are expenses that decrease your taxable income. Accordingly, by reducing taxable income, you pay fewer taxes.

The most popular tax deductions include the following:

- Packaging: costs for boxes, shipping labels, padding, and tape.

- Shipping: fees for shipping products to your warehouse, Amazon warehouses, or customers.

- Place of work: costs associated with your office (including home office) — rent, mortgage payments, insurance, utilities, and costs of maintaining or updating the workplace.

- Software and utilities: hosting costs and programs required for business operations.

- Banking, payment, and insurance expenses.

- Education: professional development expenses for you and your employees, including online courses.

- Professional services: costs for accountants, lawyers, and other professionals.

- Business conferences and trips: ticket prices, travel- and hotel expenses.

- Marketing: money spent on promoting products on Amazon, Google, Facebook, Instagram, TikTok, and print and outdoor advertising.

- Amazon seller fee: listing, transaction, and payment processing fees.

How to Improve Your Sales Tax Process Flow

Pay sales taxes like a pro. Save money and reduce the risks by focusing on the following areas:

1. Sales tax collection

Track your nexus and get permissions on time—record which products are taxed and which are not. And do not forget to manage exemption certificates — collect, store, and validate them.

2. Audit

Most companies are audited sooner or later. Therefore, keep your reports in order and hire a tax expert annually.

3. Technology

No matter how advanced the FBA sales tax software is, it should satisfy your company’s needs. Technology is advantageous when your internal business processes are ready for it.

4. Outsourcing

If you cannot handle scaling your company on your own, you can always hire sales tax professionals. They will help you fix issues and teach your employees how to manage processes effectively.

Benefits of Paying Amazon FBA Sales Tax

As we have already mentioned, timely filing of tax returns allows you to return about 1-2% of your total sales collection. You will find where to invest this money.

FBA sales tax allows you to support the public services’ activities — schools, hospitals, police, and fire departments. Also, this money is used to finance urban construction and repairs.

And, finally, you are contributing to the overall economy, helping to develop it.

Final word

The fact that Amazon collects sales taxes is undoubtedly convenient, but you must understand all the tax nuances. From our FBA sales tax guide, you have learned when to collect sales tax, how to get sales tax compliant, and how to collect, report and file sales tax.

However, to have something to pay this tax on, you need an effective promotion. Contact Profit Whales to get efficient marketing solutions for your Amazon FBA business.