Few things compare to the excitement of opening an online store. Especially when you consider that global e-commerce sales are set to reach a whopping $5.4 trillion by 2022.

The opportunities for growth in online retail are endless. But shifting inventory off your digital shelves and into your customers’ arms isn’t always the fairytale sellers imagine.

Because the truth is, the world of e-commerce moves fast. And with inventory aging by the minute, today’s retailers are losing out on an eye-watering $1.1 trillion per year due to inventory distortion. (Ouch. 😬)

The good news is, once you know what inventory aging is and how to calculate it, you can successfully avoid many of your biggest stock-related issues.

Today, we’ll share some inventory aging basics to get you up to speed, explain the key metrics for maintaining optimal stock levels, and give you practical tips to keep your sales high and inventory costs low. Let’s get into it!

Table of contents

- What is Inventory Aging?

- How to Calculate Inventory Aging

- Why Inventory Aging Matters

- 5 Must-Know Metrics to Reduce Inventory Aging Rates in Your E-commerce Store

- Keep your Inventory Moving

What is Inventory Aging?

Inventory aging is any stock that’s still hanging out on your shelves without selling fast or at its full market price.

And unfortunately, the longer you leave an inventory aging problem, the worse it gets.

For example, fashion brands need to move stock quickly to ensure stores aren’t left with seasonal or trend-specific items. But the pandemic left many with growing piles of inventory and a 36% loss in 2020 sales. Even the big box retail stores struggled to shift goods with AB Foods (owner of Primark) reporting a £284 million loss due to overstocks caused by the pandemic.

The risk is real. Here are must-knows on inventory aging to help you avoid making the same mistakes:

- There are levels to aging inventory: Inventory maturation is a natural and expected part of selling physical goods. Issues only arise when inventory sticks around for too long, which is usually around 120+ days after the stock arrives in your warehouse.

- Inventory age can guide your promotions: When the stock has been in your warehouse for 120+ days, it’s a warning signal you need to take action. You can trigger special sales during this period to recoup your investment and avoid long-term storage fees.

- Disjointed sales and inventory can cost you: Inventory aging is more common in stores whose sales pace and stock levels aren’t synchronized. It’s vital to implement a system that considers your sales velocity, plus important contributing factors like cyclicality and seasonality when making inventory forecasts to avoid expensive mistakes.

How to Calculate Inventory Aging

On the upside, stock aging isn’t complicated to measure. In fact, you can calculate inventory aging for each product in three simple steps.

Let’s break these down:

-

Work out your Average Inventory Cost

Your Average Inventory Cost shows how much stock your business typically has on hand at any given period, e.g., one year.

Here’s the formula to figure out Average Inventory Cost: divide average inventory cost by cost of goods sold and then multiply it by 365. It is generally recommended that retailers support this figure with additional inventory metrics (e.g., gross profit margin).

Here’s an example of how it could look:

-

Identify your Cost of Goods Sold (COGS)

COGS is the cash amount your products need for production. It includes line items like labor and raw materials. In your COGS calculation, you’ll also consider additional stock purchases made during your chosen period.

Here’s the formula for COGS:

For example, COGS could look like this for a year’s calculation:

-

Bring the Average Inventory Cost and COGS together

Once you have the Average Inventory Cost, you can craft the inventory aging formula. It goes like this:

Let’s look at the inventory aging formula in action:

Why Inventory Aging Matters

Inventory aging isn’t just an annoying problem you can put off for later — its effects can have far-reaching consequences like:

- Sky-high warehousing costs

- Poor cashflow

- Stock depreciation

Let’s examine some of the reasons why it pays to stay informed on inventory aging in your business:

- Identify your top-performers and ensure you stay stocked up: Tracking stock aging allows you to see which products are performing best so you can reorder with confidence.

- Spot and weed out underperforming stock quickly: Product laggards can drag inventory turnover rates down while hiding behind other successful products that prop up your sales figures. Assessing inventory age helps identify problems with lingering stock, which is particularly essential on marketplaces like Amazon, where products that stay 6+ months in Amazon’s warehouse get slammed with long-term storage fees.

- Highlight product quality issues: Sometimes, it’s not that the product idea is bad, it’s simply that the quality could be better. Tracking inventory aging helps pinpoint overstocked products, so you can find out why shoppers aren’t buying them, then work to fix the problem and improve conversion rates.

- Improve decision-making in your store: Inventory aging data allows you to make informed choices about the next steps in your store. For example, it can help you decide whether to expand a range or discontinue it.

Keep costs low: If there’s one thing guaranteed to make online sellers nervous, it’s dead stock. Not only is your money tied up in inventory, but you also have to pay to store your products, meaning that precious budget is wasted. Tracking inventory aging can help you pick up on problematic stock and take action to avoid further losses.

5 Must-Know Metrics to Reduce Inventory Aging Rates in your E-commerce Store

It’s easy to obsess over sales-focused metrics like ROI and gross margin.

But inventory health metrics are just as important.

Let’s explore some of the other inventory health metrics you don’t want to miss:

1. Carrying Cost

Carrying Cost is the total sum your business pays to keep items in stock. Because it can seriously affect profitability and scalability, your Carrying Cost shouldn’t exceed 30%.

Some contributing factors to Carrying Cost include:

- Warehousing charges

- Insurance

- Taxes

- Recovery costs

- Depreciation rates

- Costs for replacing perishable items

- Opportunity cost

- Capital costs

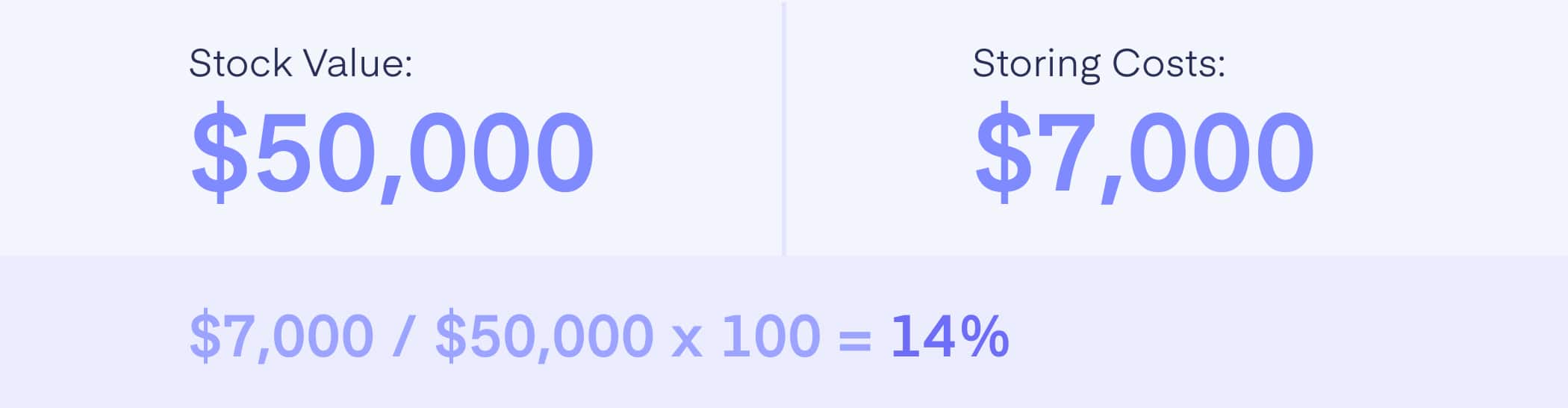

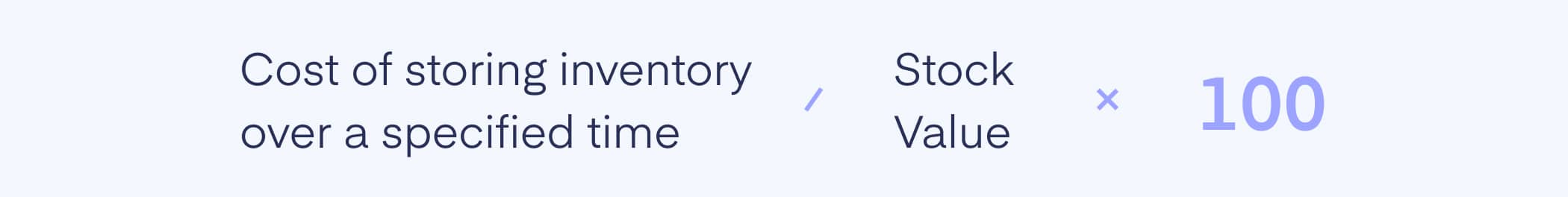

Here’s the formula to work out your business’ Carrying Cost:

The Carrying Cost formula could look like this, for example:

2. Days to Sell Inventory (DSI)

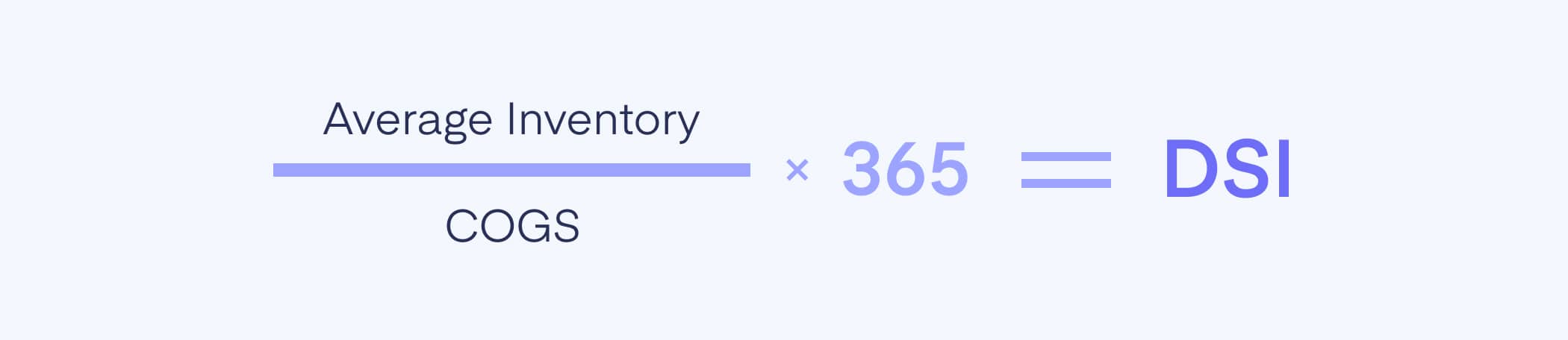

Days to Sell Inventory tells you the average days it takes your business to transform inventory into sales. The lower your store’s DSI, the better, as it indicates fewer days needed to generate cash.

But there’s no hard and fast definition of a good DSI rate, it all depends on your industry.

Here’s the formula to calculate your DSI:

In context, DSI could look like this:

3. Sell-through Rate

Your Sell-through Rate reveals the number of units sold compared to the number available in a period (e.g., a month) and is expressed as a percentage.

This metric tells you the truth about a product’s popularity and your order quantity decisions and helps assess supply chain efficiency to avoid stockouts and overstocks. Like DSI, a good Sell-through Rate depends on your industry and store, but in general, 40-80% is where you probably want to set your sights.

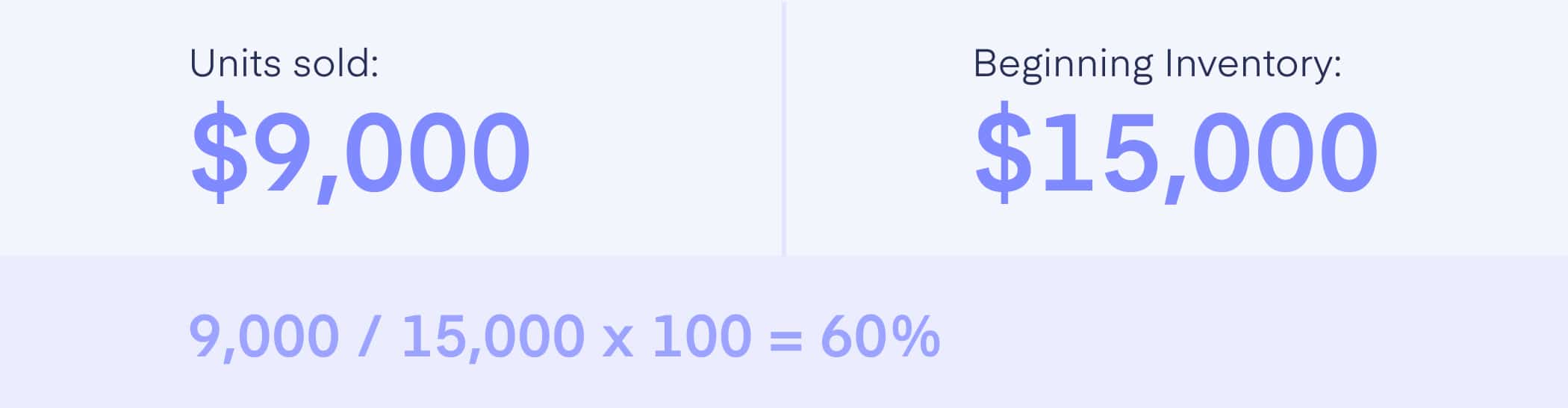

Here’s the formula to calculate your Sell-through Rate:

Here’s an example of what your Sell-through Rate could look like:

4. Inventory Turnover Ratio

Inventory Turnover Ratio might be the most important metric for inventory planning. It reveals how often a product has been bought and replaced in your store.

This metric is important because it will show you if your store has funds stuck in underselling stock, which can trigger revenue performance issues and negatively impact warehouse efficiency. In this scenario, you can take fast action to reduce losses and protect your business. Inventory Turnover Ratios between 5-10 are best, so you have enough stock on hand without needing to constantly reorder.

Here’s the formula for the Inventory Turnover Ratio:

For example, an Inventory Turnover Ratio can work out like this:

5. Days in Inventory

Your Days in Inventory figure tells you how many days’ worth of stock you have, and helps you see how fast inventory moves through your store. It’s a handy metric for spotting stock issues on the horizon, e.g., having too much stock or not enough.

Here’s the formula for Days in Inventory:

For example, a Days in Inventory calculation can look like this:

Keep your Inventory Moving

Inventory aging is like sunburn. It sneaks up on you and you only notice the damage once it’s too late. 😨

And while it’s totally fine to track inventory aging yourself, creating manual forecasts or defaulting to basic inventory management tools can increase your odds of making an expensive mistake.

That’s where Flieber can help.

Flieber uses smart AI and machine learning to automatically track important data points like sales, stock levels, and inventory age, so you instantly know how to take the next best action for your store.

Goodbye old stock, hello fast sales.

About the author

Fabricio Miranda is the co-founder and CEO of Flieber. A serial entrepreneur, he has founded or joined as early stage partner seven companies in both Brazil and the United States. Since 2016, he has been fully dedicated to the online retail segment, where he has co-founded four companies, three of them in the technology space.