Managing cash flow effectively is critical for any business, especially for Amazon sellers. Whether you’re just starting or have years of experience, understanding how and when you will receive payments from Amazon is vital to running your business smoothly. Amazon offers various payment schedules and methods, each with advantages and limitations.

Introduction

Selling on Amazon provides numerous opportunities, but managing your cash flow can be challenging if you don’t fully understand the Amazon seller payment schedule. Unlike some e-commerce platforms where sellers may get paid almost instantly after a sale, Amazon follows a structured payment system that includes a variety of terms, waiting periods, and potential delays.

Amazon ensures buyers and sellers are protected through this system, which adds a layer of complexity to how and when payments are disbursed. By understanding the nuances of the Amazon payout process, sellers can better anticipate when they will receive their earnings, plan for expenses, and reinvest in their business.

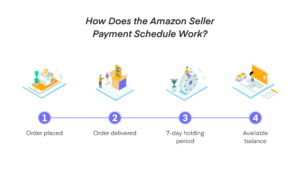

How Does the Amazon Seller Payment Schedule Work?

At its core, the Amazon seller payment schedule operates bi-weekly. This means that every 14 days, Amazon disburses available funds from your account to your registered bank account. However, this schedule has several important caveats that can impact when you see the money.

After you make a sale, Amazon doesn’t immediately transfer funds to your account. Instead, Amazon holds those funds for a period of time—usually until seven days after the product has been delivered to the buyer. This holding period allows Amazon to manage potential returns, chargebacks, or disputes.

Once this holding period expires and no disputes or issues arise, the funds become available for disbursement. Your available balance is calculated based on all the orders that have passed the holding period, minus Amazon’s fees (such as referral fees, FBA fees, and shipping costs).

Here’s a simplified breakdown of the process:

- Order is placed: A customer buys a product.

- Order is fulfilled: The product is shipped and delivered.

- Holding period: Amazon holds the payment for at least seven days after the confirmed delivery date.

- Available balance: Funds from the sale become part of your available balance after the holding period.

- Disbursement: Every 14 days, Amazon transfers the available balance to your bank account minus any fees or reserves.

In addition to this bi-weekly cycle, Amazon offers options to sellers who require more frequent access to their earnings, such as daily payouts or next-day payouts. Still, these options come with specific eligibility criteria.

Key Amazon Seller Payment Terms

Before diving deeper into Amazon’s payout system, it’s important to understand some key terms you’ll encounter when managing your payments on Amazon Seller Central. These terms will help you navigate your account and understand how funds move through the system.

Disbursement

A disbursement refers to the transfer of funds from your Amazon seller account to your bank account. This is the actual payout that you receive based on your available balance. Disbursements occur every 14 days unless you qualify for more frequent payouts, such as daily or next-day payouts.

It’s important to remember that the amount you receive in a disbursement isn’t the full amount of sales made during the period—it’s the total sales amount minus Amazon’s fees, any applicable refunds, and any money held in the account level reserve.

Account Level Reserve

The account level reserve is a portion of your earnings that Amazon holds back to cover potential risks such as returns, disputes, or chargebacks. Amazon retains these funds to ensure sufficient resources are available to handle any financial obligations you might incur as a seller.

The reserve size can vary based on your sales history, order defect rate, and other factors. Sellers with a high order defect rate (ODR), frequent returns, or a less stable account history may see larger amounts held in reserve. Conversely, sellers with a proven track record of reliable sales and few issues will typically have a smaller reserve.

Holding Period

The holding period is the time between a sale and when the funds from that sale become available for disbursement. For most sellers, this period is seven days after the delivery of an order. This delay allows Amazon to verify that the transaction has been completed satisfactorily and that the buyer has no issues with the product.

Once the holding period expires and no returns or disputes are initiated, the funds become part of your available balance and are included in your next scheduled disbursement.

Amazon Seller Payment Options

Amazon understands that different sellers have different cash flow needs, which is why the platform offers multiple payout options. Depending on your business model and financial requirements, you can choose from daily, next-day, or bi-weekly payouts.

Daily Payouts

Daily payouts allow you to receive funds from Amazon daily rather than waiting for the bi-weekly disbursement. This option is especially beneficial for sellers who need a consistent flow of funds to manage day-to-day operations such as restocking inventory, paying employees, or handling shipping costs.

To qualify for daily payouts, sellers need to maintain a strong account standing, including a low order defect rate, and meet Amazon’s other criteria. Not all sellers will qualify for this option, and even those who do may face higher fees for the service.

Once eligible, you’ll receive funds from your available balance each day, and those funds will reflect sales made during the prior 24 hours, as long as they’ve passed the holding period.

Next-Day Payouts

Similar to daily payouts, next-day payouts give sellers faster access to their funds. In this case, payments are processed the day after the order is shipped and confirmed. This option is ideal for businesses that want more frequent access to their cash but don’t necessarily need daily payouts.

Sellers who meet the criteria for next-day payouts can streamline their cash flow while still benefiting from faster access to funds than the standard bi-weekly schedule.

Standard Payouts

For most sellers, the default option is bi-weekly payouts. Every 14 days, Amazon will disburse your available balance. This balance includes all sales that have passed the holding period minus any fees, refunds, or reserves. The bi-weekly payout is the most common option and works well for sellers with stable cash flow and less urgency for quick access to their funds.

While it’s less frequent than daily or next-day payouts, the bi-weekly schedule is consistent and predictable, making it easier for businesses with steady income streams to plan.

What Is Amazon’s Account Level Reserve?

The account level reserve is a financial safeguard Amazon uses to mitigate risk. It’s a portion of your sales revenue that Amazon temporarily holds to cover potential issues such as returns, chargebacks, or other disputes. This reserve is meant to ensure that even if problems arise, your account has sufficient funds to cover the liabilities.

Your account level reserve size can vary based on your account’s history, the type of products you sell, and your overall performance metrics. For example, new sellers or sellers in high-risk categories might have larger reserves, while established sellers with low return rates may have smaller reserves.

Amazon evaluates your account regularly and adjusts the reserve amount as necessary based on your order volume, order defect rate (ODR), and other factors that may impact your account’s risk profile.

How to Minimize Account-Level Reserve?

Minimizing your account level reserve is essential if you want to access a larger portion of your funds more quickly. Here are a few strategies to reduce your reserve:

- Maintain a Low Order Defect Rate (ODR): The lower your ODR, the less risk Amazon associates with your account, which can lead to a smaller reserve.

- Monitor Your Account Health Regularly: Keep an eye on your Account Health Rating in Amazon Seller Central to ensure there are no issues that could increase your reserve amount.

- Reduce Returns and Cancellations: Offering accurate product descriptions and ensuring timely deliveries can help reduce the number of returns, which can also affect your reserve.

How to View Your Amazon Seller Payment Schedule

Viewing your Amazon seller payment schedule is easy through the Amazon Seller Central dashboard. To access your payment schedule:

- Log into Amazon Seller Central.

- Go to the “Payments” tab, where you’ll see details on your current balance, pending payments, and the date of your next payout.

- From this section, you can also view past disbursements, breakdowns of fees, and any reserves applied to your account.

Monitoring your payment schedule is crucial for keeping track of when you’ll receive funds and managing your business expenses.

How to Get Amazon Seller Payouts Faster

For many sellers, waiting for the bi-weekly payout can create cash flow challenges, especially when you need to restock inventory, pay suppliers, or cover operational costs. Fortunately, there are several ways to expedite your Amazon seller payouts.

Express Payout

Amazon Express Payout is a service that allows eligible sellers to receive their payouts more frequently than the standard bi-weekly schedule. With Express Payout, you can get access to your funds much faster, making it easier to reinvest in your business, cover expenses, and maintain a steady cash flow.

However, eligibility for Express Payout depends on maintaining a healthy seller account, meeting Amazon’s performance metrics, and potentially paying additional fees for the service.

Fees and Eligibility for Express Payout

While Express Payout offers faster access to your funds, there are some important factors to consider:

- Eligibility criteria: Not all sellers qualify for Express Payout. Amazon typically offers this service to sellers with a proven sales history, a low order defect rate, and excellent performance metrics.

- Fees: Faster payouts may come with additional fees. These fees can vary depending on the frequency of the payouts and the region in which your account is based. Review the costs before opting for this service to determine whether it makes financial sense for your business.

By using Express Payout, sellers can mitigate some cash flow issues associated with the bi-weekly payout schedule. Still, evaluating whether the associated fees are worth quicker access to funds is important.

Common Payment Issues and Solutions

Despite Amazon’s robust payment system, sellers occasionally encounter issues that can delay their payouts. Understanding these problems and how to resolve them quickly is crucial for maintaining smooth operations.

Common Payment Problems

Discrepancies in available balance: Sometimes, sellers notice a discrepancy between their expected payout and the available balance. This could be due to returns, refunds, or funds held in the account-level reserve. Always check your payment dashboard for a breakdown of fees and reserves.

- Bank account issues: If your bank details need to be corrected or updated in Amazon Seller Central, your payout may be delayed. Ensure your bank account information is always current to avoid failed disbursements.

- Currency conversion delays: For sellers who sell on multiple international marketplaces, currency conversion can sometimes cause delays. Ensure you understand how currency conversion works and factor in potential delays when selling internationally.

Solutions:

- Regularly review your account: Make it a habit to regularly check your payment dashboard to ensure all transactions, fees, and disbursements are accurate.

- Update bank information: Always keep your bank account details up to date in Seller Central to avoid any interruptions in your payout process.

- Contact Amazon Seller Support: If you encounter a significant issue with your payout, don’t hesitate to reach out to Amazon Seller Support for assistance in resolving the problem.

By staying proactive and keeping a close eye on your account, you can avoid most common payout issues and keep your business running smoothly.

Tips for Managing Your Amazon Payment Schedule

Successfully managing your Amazon seller payment schedule can help ensure that your business remains financially stable and ready to grow. Here are a few strategies to keep in mind:

- Stay on top of financial data: Regularly monitor your payments dashboard to track your available balance, next disbursement date, and any funds held in reserve. Understanding your cash flow will help you plan for upcoming expenses.

- Build a cash reserve: Maintaining a cash reserve outside of your Amazon payouts can provide a buffer for unexpected delays or large expenses. Having a backup source of funds will give you more flexibility in managing your business.

- Leverage business credit cards or loans: Using business credit cards or short-term loans can help cover immediate expenses while you wait for your next payout. Just be sure to manage debt responsibly to avoid interest charges.

- Adopt multichannel selling: Diversifying your revenue streams by selling on other platforms can reduce your dependence on Amazon’s payout schedule. By selling on multiple channels, you can stabilize your cash flow and reduce risks associated with delayed payments from a single platform.

Use supplier payment terms to your advantage: Negotiating favorable payment terms with your suppliers can give you more breathing room when managing your cash flow. For example, if your supplier offers 30- or 60-day payment terms, you can use your Amazon payouts to cover inventory costs without needing immediate access to funds.

Summary

Managing your Amazon seller payout schedule effectively is crucial to maintaining a healthy cash flow and growing your business. Understanding how Amazon’s payment process works, what key terms mean, and how to reduce reserves can help you optimize your payouts and avoid potential delays.

By utilizing faster payout options like Amazon Express Payout and proactively managing your finances, you can gain quicker access to your earnings, improve liquidity, and ensure that your business runs smoothly. For more guidance on optimizing your Amazon payouts and growing your business, visit Profit Whales or contact us for personalized support.

FAQ

How often does Amazon update the seller payment schedule?

Amazon updates its seller payment schedule every two weeks, with payments typically processed every 14 days. However, payments can be more frequent for sellers who qualify for daily or next-day payouts. Be sure to regularly check your Payments Dashboard in Seller Central to stay up-to-date on your next disbursement date.

What happens if there is a dispute or refund request? How does it affect my payout schedule?

When a buyer initiates a dispute or requests a refund, the amount for that order is typically withheld from your next payout. Amazon may hold funds to cover any potential liabilities related to the dispute until it is resolved. This could delay your payout or reduce the amount of your disbursement.

Can I choose different payout schedules for different Amazon marketplaces?

No, your payout schedule is consistent across all Amazon marketplaces where you sell. However, currency conversion times and fees may affect the timing and final amount of your disbursement when selling in international marketplaces.

Does my payout schedule change if I switch from an individual seller account to a professional seller account?

Switching from an individual seller account to a professional account does not automatically change your payout schedule. However, professional sellers may have access to more advanced tools and services, such as Express Payout, which can offer faster disbursement options.

How do currency conversions affect my Amazon payouts?

If you sell on international Amazon marketplaces, Amazon will convert your sales revenue into your local currency before disbursing the funds to your bank account. Currency conversion rates fluctuate, and additional fees may apply, which can slightly reduce the total amount you receive.