The Profit Whales Case Study unriddles the puzzle of the cross-channel marketing system of functions and its powerful influence on the business under the elaborate management.

Company Background

A North American brand has been selling on Amazon since August 2019. The company distributes eco-friendly products: natural decorative cosmetics, skinfood, hydrating masks and repair ointments. Their packages contain no plastic and, in general, no unnatural components. Therefore, it is entirely disposable.

Brand loyalty has always been a strong quality of the company. They built a circle of customers who knew that the brand was trustworthy and cared about the humans and the world around them.

The Challenge

At the beginning of 2021, when three new products were launched, brand owners realized that the driven to the product detail pages traffic stays approximately on the same level. Furthermore, the number of sales also don’t change.

The only thing that has changed was the ad sales and organic sales ratio. Ad sales were the definite leader in this race. Since the brand wasn’t new on the marketplace, it was a problem that had to be fixed immediately.

The brand’s goal was to turn around the issue with ad sales before Q4 and stabilize ACoS, which had to get at least to the break-even point by October.

The Solution

Since Profit Whales started to work on the brand’s improvement, it was clear that the brand didn’t use all the opportunities to grow business as much as possible and as the e-commerce world allows.

They concentrated on advertising and selling their products on Amazon without utilizing the hidden potential of cross-channel marketing. Additionally, it was necessary to look beyond PPC advertising.

Profit Whales has launched external advertising on Shopify, one of the largest platforms in the U.S. By clicking on ads, customers are landing on Amazon product pages. Such an advanced move significantly increased driven to the product detail page traffic. With the help of an entirely new set of DSP targeting options, big Amazon sellers greatly widened the relevant advertising audience, which led to an improved percentage of conversion rate and a more considerable number of sales.

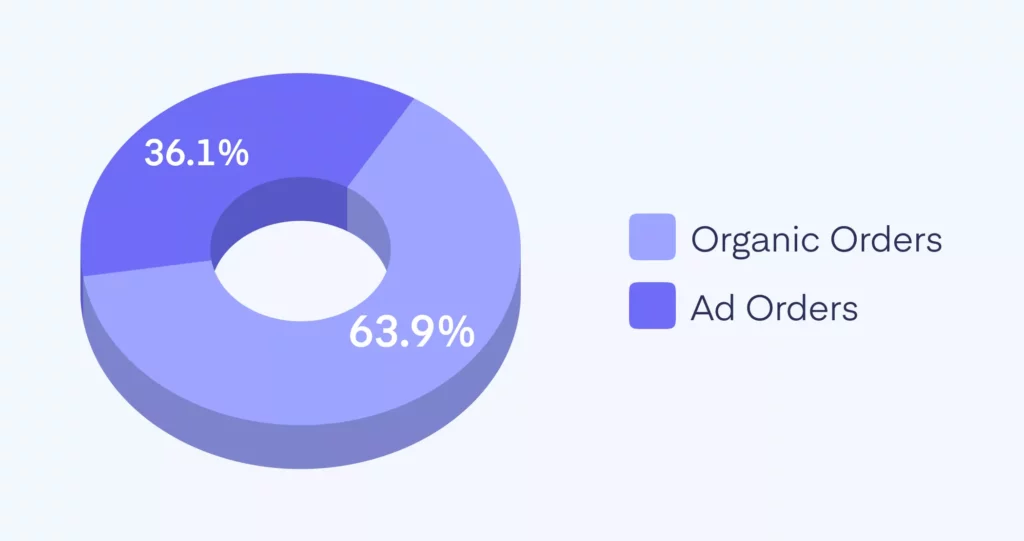

During Q3 brand’s metrics on Amazon got to the point where ACoS got lower than break-even ACoS ― 29,82%. As a result, ad sales finally stopped surpassing organic sales, and organic sales took up 63,9% of total sales on Amazon.

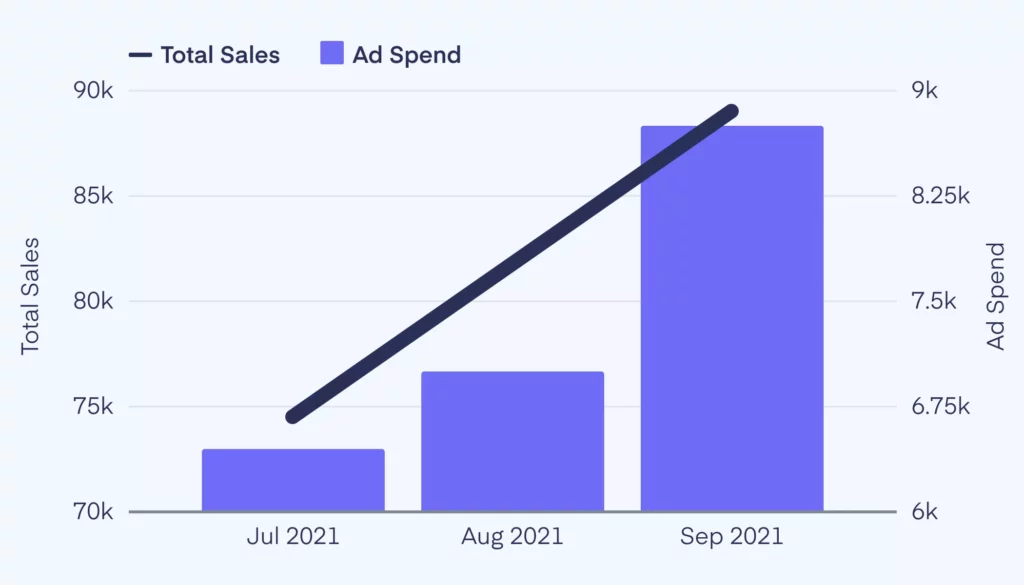

In September 2021, the brand’s total sales on Amazon grew to 88 748 with ad spend only 8 631, when in July, total sales were 74 879 with ad spend 6 368. Also, the ads buying funnel showed noticeable improvement during this period. Click-through rate increased by 0.9%, click rate by 24% and order conversion rate by 12%.

Such an improvement of metrics shows that Profit Whales took the right path of diversifying advertising and selling channels. Nevertheless, distributing and promoting products on another platform was reasonable not exclusively from the side of stronger development on Amazon but also from exploring the same niche on the other platforms and seeing what they have to offer.

The products launched on Shopify showed successful results already in July with 17,48 and total sales of 862,88. In August, the brand experienced a minor decrease in total sales ― 786,04, and in total orders ― 16,42. Fortunately, in September the numbers rose higher than ever before, total sales 846,42 and total orders 17,63.

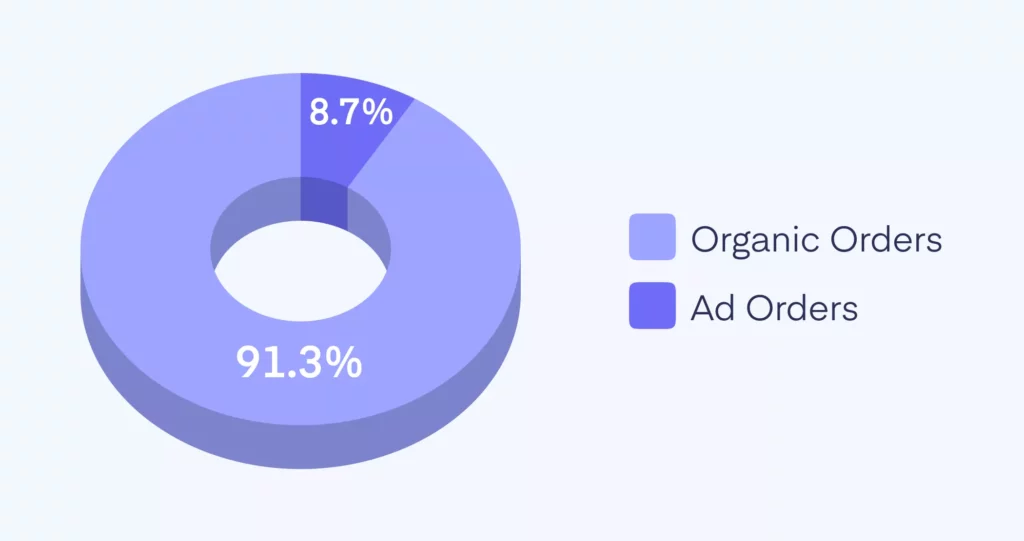

Despite the significance of these numbers, the most impressive is the ratio between organic and ad sales ― 91,3% to 8,7%. The total sales on Shopify increased to 76,5 thousand. Out of them, 71 654,38 are organic sales. The rest 4 854,79 are ad sales, with 1 390,00 ads spent.

Outcomes

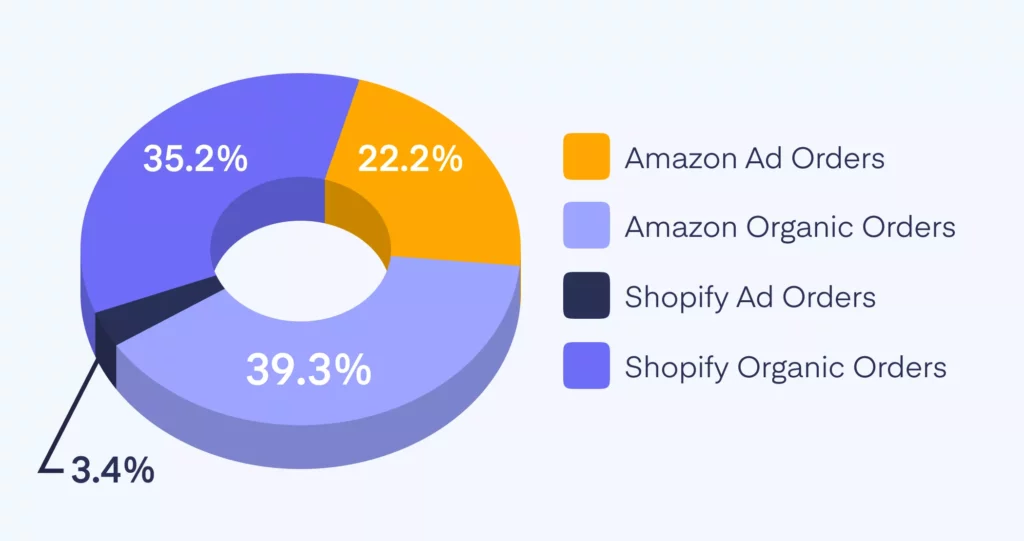

Taking into consideration the thorough 3-month work in cooperation with Profit Whales, the apparent positive changes came fast. The total number of orders was 4,1 thousand. The leader of total orders stayed Amazon organic orders, as it was expected, 1610,67 (39,3%). Shopify organic orders didn’t fall behind ― 1442 (35,2%).

The Amazon ad orders were 910,67 (22,2%), and Shopify ad orders were only 138 (3,4%). The major difference between Shopify organic and ad sales is very important. The advertising on each platform has to work to get more and more organic orders because ad spend also grows with ad orders and sales.

Advertising on each platform is created to promote products and stay in buyers’ minds and come back for products in the future.

It’s vital to notice that external traffic that comes to Amazon product detail pages is seen from Amazon as organic traffic, so it’s essential to launch external advertising and improve organic ranking.

To sum up, the launched products and campaigns on external platforms performed better than expected at the beginning. Further cooperation with Profit Whales is foreseen to present campaigns on new platforms and enlarge the brand’s audience.